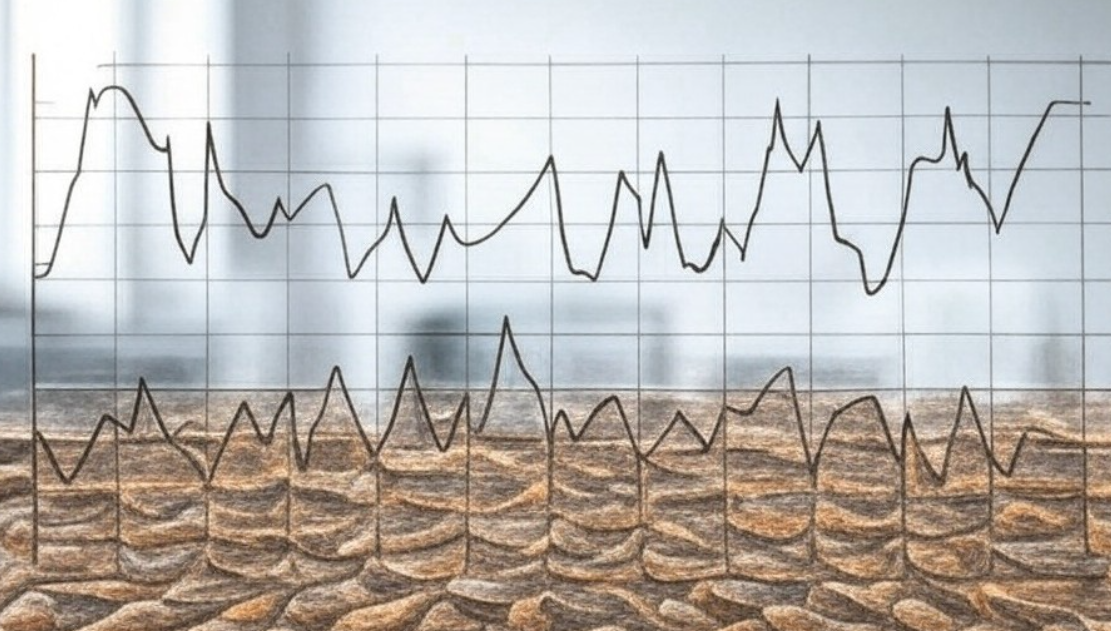

As of early 2025, mortgage rates in Hawaii are averaging around 7.00% for a 30-year fixed mortgage and 6.13% for a 15-year fixed, a slight decrease from last year’s highs but still significantly above the historical lows seen during the height of the global health crisis. These rates reflect a national trend influenced by broader economic indicators such as inflation rates, Federal Reserve policies, and global economic stability.

-

Gradual Decline Expected: Experts from various financial institutions predict a gradual decline in mortgage rates throughout 2025. Fannie Mae forecasts rates to close at around 6.5% by the end of 2025, suggesting a slow but steady decrease.

-

Economic Factors at Play: The Federal Reserve’s approach to interest rate adjustments plays a pivotal role. If economic growth remains steady without significant inflationary pressure, we might see rates dipping into the mid-6% range by year’s end. However, unexpected spikes in inflation or economic downturns could alter this trajectory.

-

Impact of New Administration: With a new presidential administration, policies could shift, potentially affecting mortgage rates. Analysts are watching the economic policies closely, as proposed tax cuts or tariffs could influence inflation and, in turn, interest rates.

-

Local Expertise: Our team has deep insights into the Hawaiian market, understanding local nuances that can affect your mortgage.

-

Personalized Service: We tailor our advice based on your personal financial situation, goals, and the latest market trends to secure exceptional rates.

-

Proactive Strategy: We keep you informed with real-time updates on rate changes, helping you decide the best time to lock in or refinance.

Contact our team of local experts at C2 Hawaii to explore your options today: Contact Us